The Changing Face of eCommerce in Thailand

Thailand, while not the most populous nor wealthy country in South East Asia, is currently at the epicenter of an eCommerce boom – occupying the fourth largest eCommerce market in the region, a market that is set to blossom to a value of $11.1 Billion by 2025.

The progress is powered by a handful of key aspects:

(1) the growing number of Thai people getting access to the internet,

(2) the use of mobile phones in internet usage and shopping,

(3) the growth of social media platforms,

(4)fueled further by the launch of and extension of 4G services.

It appears 4G development combined with a growing middle class are at the crux of the transformation, bringing faster and faster connectivity to an increasing number of people with disposable income. The rapid expansion has resulted in a slew of international companies and heavily backed start-ups looking to form partnerships or launch eCommerce solutions in the region. This has been followed by companies looking to provide the services that make the eCommerce value chain function: Warehousing, Logistics, Marketing, and Development.

As more people get online, more opportunity will arise. In Thailand, this is predominantly influenced by social media platforms: Facebook, Instagram, and LINE. Companies in the eCommerce space are developing fast and evolving with user’s interest. Line is a perfect example of this, with 33 million users in Thailand it’s expanding offerings and moving their chat product beyond simple messaging. Developments will allow for taxi booking and payments for goods.

The numbers:

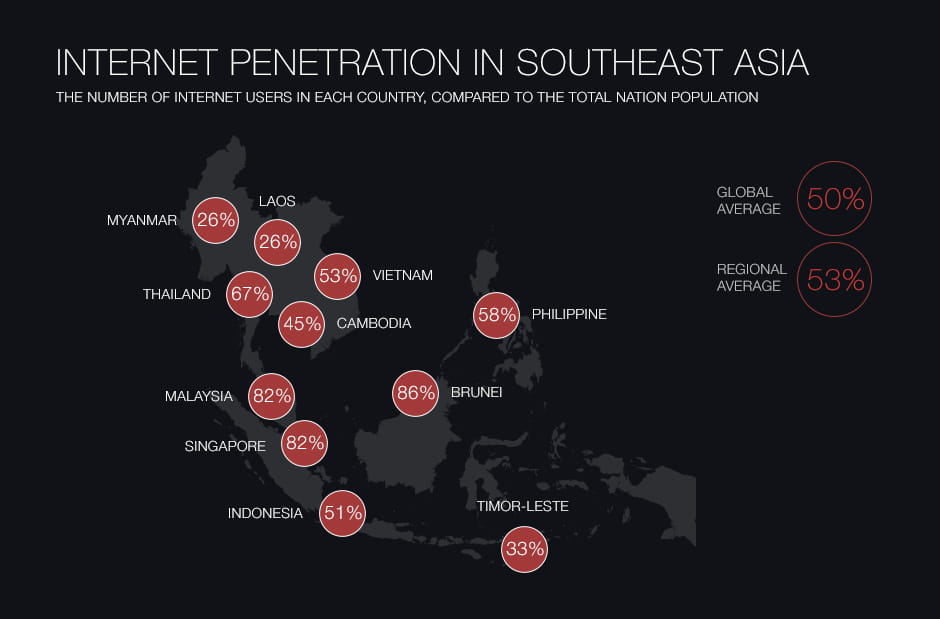

67% of the Thai population have access to the internet per We. Are. Social’s 2017 study, but consider this in a population of 68.3 million people, of which only 52% are living in urban environments with easy to access to the internet.

Despite infrastructural issues, internet usage has grown 21% since January 2016 enabling 8 million more people to become active on social media platforms on mobile devices. The use of mobile phones in Thailand is well documented with 105% market penetration and 96% of the population owning atleast one, 21.8% of Thai’s have a smartphone while only 26% have a computer and 11% a tablet. Use of laptops is on a sharp decline, down 46% on last year, while mobile phone usage rose by 47%. The conclusion is an increasingly online, mobile and social media based market.

90% of Thai’s use their phone as their primary way to get online. By far the most common use for smartphones is to visit social networks, 46 million are active social media users: about 67% of the overall Thai population – or virtually everyone who has internet access.

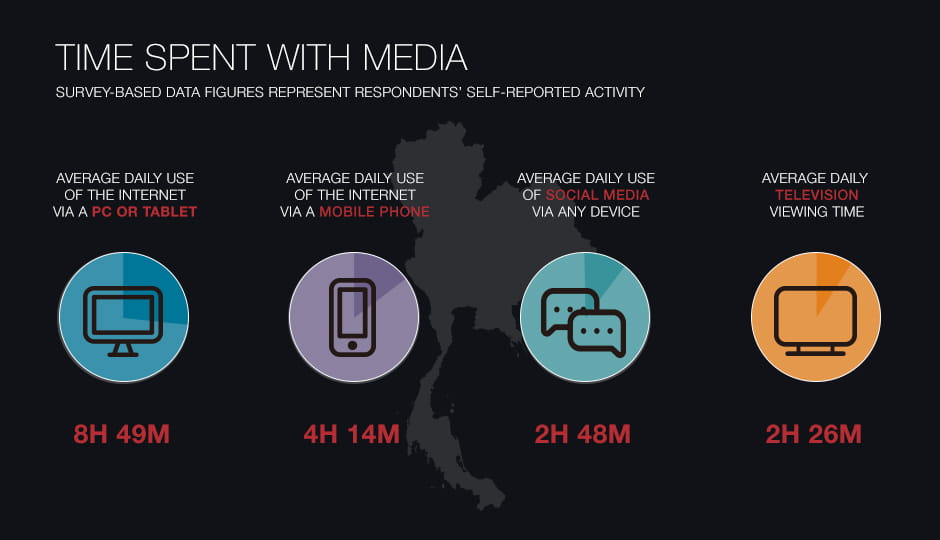

Average daily use time of the internet on a PC or tablet is at 8 hours and 49 minutes, the average use of internet on a mobile phone is 4h and 14 minutes, over half of which is spent on social media with 85% of the population noting they use social media at least once a day.

But how do these numbers relate to purchases I hear you ask? Well, a surprisingly high 41% of Thai’s said they have made a purchase online in the last 30 days via mobile devices, while only 29% made a purchase with a laptop or computer. It is no surprise that Social networks drive purchases with 50% of online shoppers purchasing products through social networks.

Bottlenecks:

In an era of rapid eCommerce growth across the planet and 2/3rd of the world going online, developing markets have been the target for investment. Amazon are moving into South East Asia in 2017 and Alibaba arrived vicariously in 2016, all the while in the Thai marketplace only 3% of all retail transactions come from online channels.

This issue is two-fold, 1. the companies in Thailand aren’t moving online and 2. The consumer base is not buying online – but why the trepidation?

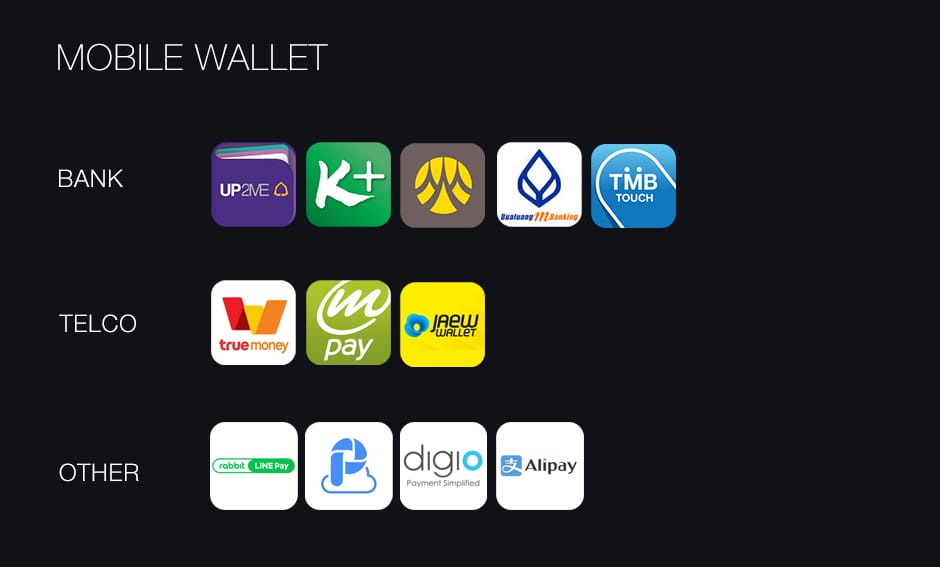

Cash is still king, Thailand’s economy is still cash driven, and cash on delivery is the preferred payment method for 70% of eCommerce shoppers. Large portions of the Thai population don’t have a bank account. This issue has been tackled head on by the rise in Fintech and payment gateway start-ups like Omise and TrueMoney voucher codes.

There is a general distrust of the financial sector and studies have shown that fraud is pervasive in Thailand, 32% of respondents in a DataOne Asia study said they have experienced fraud in the last 12 months, with ATMs, eCommerce and mCommerce the primary sources. Only 17% believe mCommerce and eCommerce data will be kept safe by stores and this is one of the core reasons it hasn’t taken hold.

Businesses are still coming to terms with the eCommerce value chains, including large companies. In a study by eCommerce IQ, 47% of respondents said that the main reason for not selling online was limited internal expertise or resource. To pursue online ventures and technology in general you need to have a pool of skilled developers from which to draw from, this seems to be a critical sticking point in Thailand’s online development.

Low demand is also problematic, even as the marketplace grows. Due to the small portion of purchases through online channels, companies feel that any initial growth would directly cannibalize their offline sales instead of adding value. The idea that SMEs should get involved in eCommerce today to reap rewards tomorrow is often doubted by the business owners.

Troublesome infrastructure is somewhat inevitably a sticking point for eCommerce growth in the region. Logistically there is complex cross-border regulation in the South East Asian region, and complete postal coverage within Thailand is sometimes unreliable with last mile delivery lacking consistency.

Most Thai internet users are still on dial-up connections, although broadband is available in major cities. They have an internet penetration rate of around 67%, which is below Malaysia, but ahead of Indonesia and Vietnam. It has also doubled since 2012, where it was estimated that only 1/3rd of the nation had access to the internet. The average online annual spend in Thailand seems small at $212, below other eCommerce growth hub Indonesia, ($228) but higher than Malaysia, Vietnam and Laos.

The Boom:

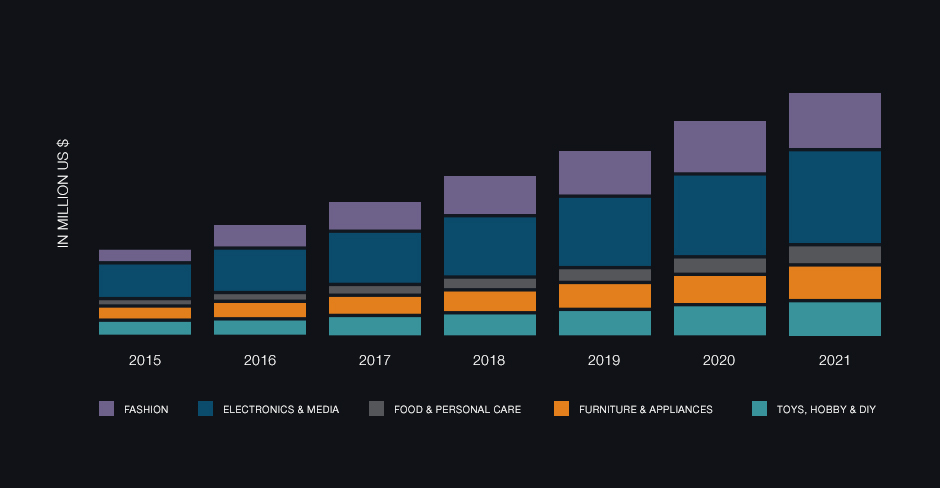

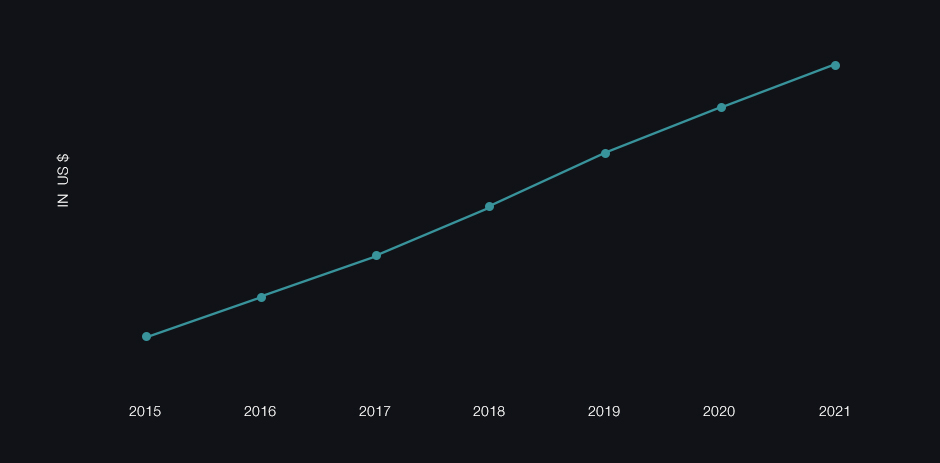

As it stands eCommerce makes up a small portion of internet usage and a thin slice of the whole commerce pie, only 1% of Central groups revenue came from online sales last year. With this said, eCommerce has been growing rapidly and is expected to increase more than 15% annually over the next 4 years. To speed up development of the eCommerce sector, late last year, the Thai government developed an initiative with the assistance of Alibaba dubbed the “People and Talent Development Program”, which aims to train the 30,000 Thai SMEs involved with Alibaba, and the training of a further 10,000 people in digital development.

Although cash is king in Thailand – most transactions are carried out via bank transfer. There has been a surge of fintech players developing Mobile wallets: Rabbit Line Pay, AirPay, digio and Alipay have all tried to move into the market with a huge opportunity for the company who can provide a solution that allows for those without a bank account and/or credit and debit card to make transactions.

The younger generation is leading the way in breaking down barriers with 32% having made cross-border payments in the last month, and 40% saying they would be more likely to use alternative payment methods like Cash on Delivery, e-wallets and PayPal as opposed to traditional methods like Debit and Credit card.

By Leveraging Thailand’s leanings towards Social interactions through mobile phones, Line has formed a partnership with Rabbit under Rabbit Line Pay: https://line.me/th/pay, and Rabbit Finance also forming a payment gateway partnership with Omise: https://www.omise.co/featured-customer-rabbit-finance.

There will be big wins for the fashion and electronic & media markets. As the country familiarizes itself with eCommerce inevitably Fashion will be on the rise, with Zalora being acquired by Central Group, they seem as the front runners. The electronics market is one that Lazada seem to be heavily geared towards and Alibaba will have an interest in, particularly when Amazon enters the market later this year.

The growing middle class is what make emerging markets so appealing to companies. Thailand’s average revenue per consumer is expected to double in the next 5 years. Ultimately this is the most important factor – how much disposable income do Thai people have and how willing are they to spend it online.

Patience is key in a market that is being heavily invested in. Hurdles will appear, but they will be crossed at Thailand’s eCommerce push comes to fruition.

Digital Marketing Manager at Aware Group: Working his way through the world of technology and Thailand as best as he can. Happy to contribute to other tech publications.